We recently closed on a quadplex in Charleston Manor, which gives us the perfect opportunity to step back and look at the state of the Pensacola multi-family real estate market. Multi-family properties—especially duplexes, triplexes, and quadplexes—remain some of the most sought-after investments in Pensacola real estate but rising costs and shifting market conditions are influencing how buyers approach these opportunities.

👉 Watch our full market update here:

Sales Prices on the Rise

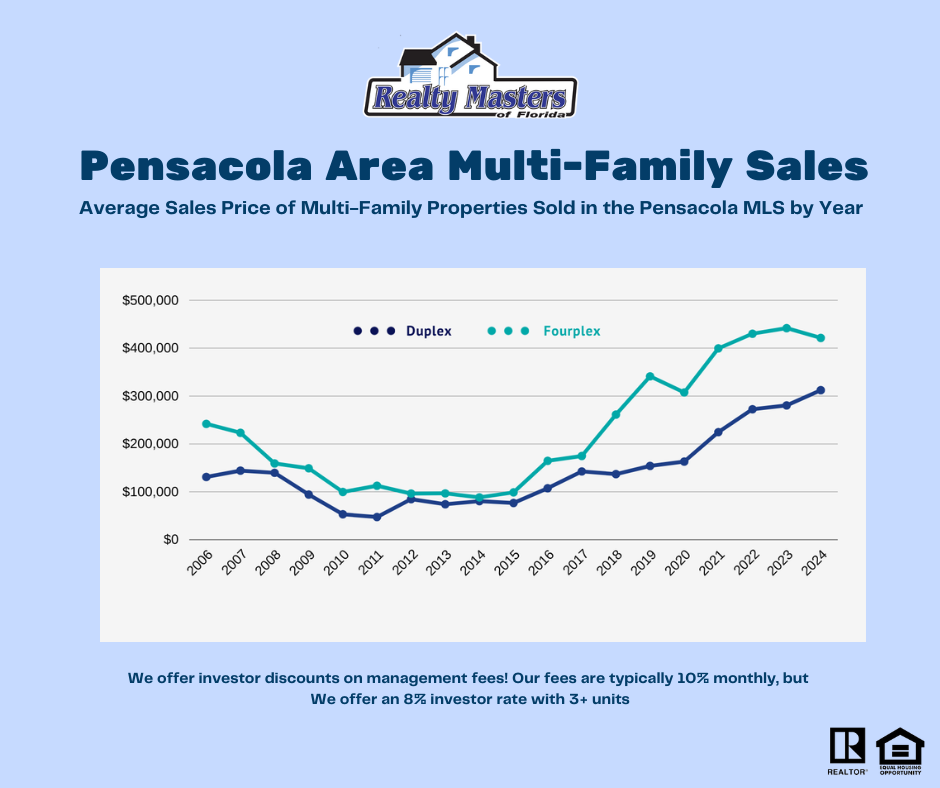

MLS data shows that multi-family sales prices have been climbing for more than a decade:

- Duplexes: The average sales price reached just over $300,000 in 2024, up from under $100,000 in the early 2010s.

- Quadplexes: Quadplexes are averaging around $425,000 in 2024, reflecting strong investor demand for larger rental properties.

Unlike the single-family housing market in Pensacola, which has seen some year-over-year declines, multi-family sales prices continue to rise, demonstrating ongoing investor confidence even as rental demand slows.

Number of Sales

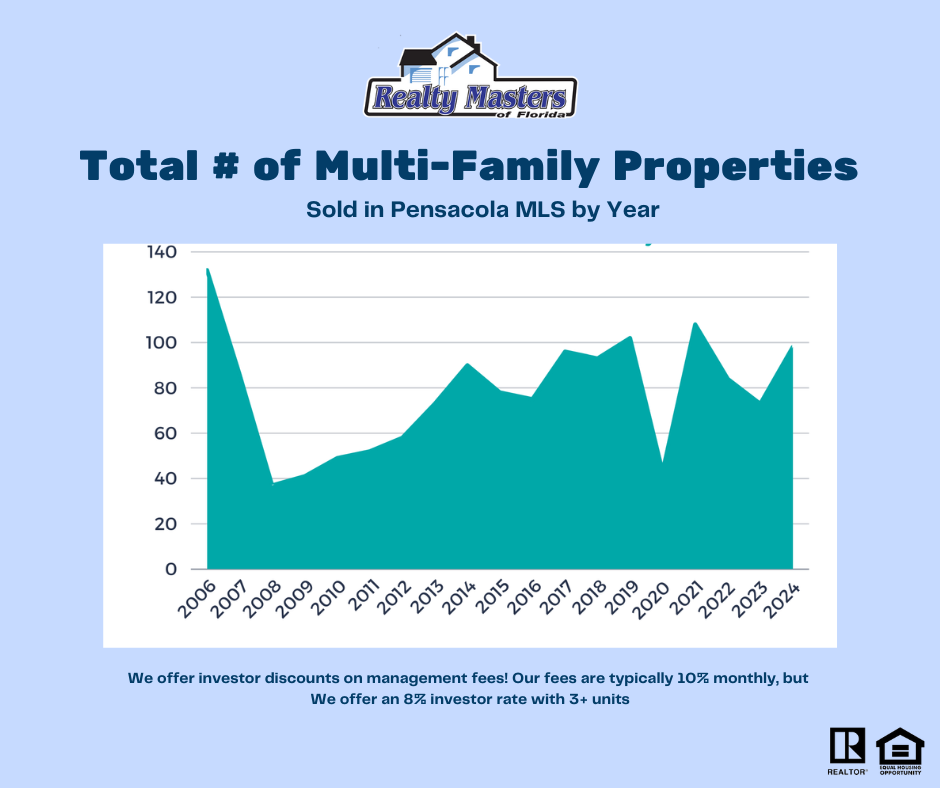

Sales activity has remained steady despite higher interest rates:

- Over the last decade, the Pensacola MLS has averaged 70 to 100 multi-family transactions per year.

- In 2024, nearly 100 multi-family properties closed, consistent with historical averages.

This stability highlights how multi-family remains one of the strongest niches in the Pensacola real estate market, though true cash-flowing properties are harder to find.

The Challenge: Cash Flow

Investors face increasing challenges when searching for cash-flow-positive properties:

- Rising Operating Expenses: Property taxes, insurance, utilities, and maintenance costs continue to increase across Florida.

- Higher Purchase Prices: Duplexes and quadplexes are selling for significantly more than in past years.

- Increased Interest Rates: Higher financing costs cut into margins.

- Softening Rental Market: Pensacola, like other Florida metros, has seen rental demand begin to cool after years of high growth.

Together, these factors mean investors must carefully analyze each property to ensure it meets their financial goals.

Even with these challenges, multi-family properties remain a cornerstone of Pensacola real estate investing. Investors appreciate the built-in diversification of multiple units under one roof, and long-term appreciation trends continue to look strong. Unlike single-family homes, multi-family properties have not seen year-over-year sales price declines, showcasing their resilience and popularity. For investors, the bottom line is this: finding a cash-flowing investment is more difficult, but demand for multi-family properties in Pensacola is as strong as ever.

Thinking About Buying or Selling Pensacola Multi-Family Property?

At Realty Masters of FL, we’re uniquely positioned to help multi-family property owners maximize their investment. With the largest network of investor clients in the Pensacola area and extensive experience closing sales on duplexes, triplexes, and quadplexes, our team brings both market insight and practical expertise. We can assist in a number of ways—from providing professional property management to advising on market rents, operating expenses, and long-term investment strategy. Whether you’re buying, selling, or simply evaluating your options, we’ll deliver a detailed market analysis and thoughtful recommendations to support your goals.

If you’d like to better understand the value of your property or explore opportunities in the Pensacola multi-family market, reach out to our team today—we’re here to guide you every step of the way.

✅ Looking to buy or sell multi-family property in Pensacola? Contact Realty Masters of FL today to discuss your investment goals.